CWHL & Canadian Women`s Hockey: The History of Famous Awards, League and Championship

By Johan Syrén, Canadian sport & iGaming expert.

Content

With over 130 years of play, Canada women’s hockey has established its illustrious traditions right alongside, but separate from those of the men’s sport. The natural love and passion for excellence have driven women’s hockey teams around the world to excel even as its nexus remains in North America. One of the most exciting facets of women’s hockey emerges almost yearly in the resumption of the heated rivalry of Canada versus USA women’s hockey.

History of Canada’s Women’s Hockey and the Coming IIHF Championships

In the 1880s, a little under a century after a gaggle of boys at King’s College School in Windsor started playing “hurley on the ice,” the Governor-General of Canada made a decision of enormous historical consequence.

Frederick Stanley, 16th Earl of Derby, ordered the lawn of Government House filled with water during the winter, creating an ice rink for his family. He likely had little idea when he stated that his family pastime would launch Canada women’s hockey, along with leagues featuring some of the best female athletes in the world.

Shortly thereafter, this British noble family’s passion for Canada’s homegrown sport of hockey helped to boost it from a pastime of children, into one of the world’s favorite sports for both men and women. This is where the story of Canada women’s hockey began to take flight.

Lord Stanley knew no bias when it came to the game he loved. He, along with his wife and daughters, played the game regularly and with relish. One daughter in particular, the future Lady Isobel Gathorne-Hardy, adopted the sport as a personal cause and promoted it her entire life.

The first Tournament

The first game of women’s hockey likely took place in 1890 between a Government House team, likely starring the future Lady Gathorne-Hardy, and a team representing Rideau Hall.

Today’s players would be amazed by the uniforms of this period. Players wore tall fur caps and bulky, but warm, ankle-length woolen dresses.

With promotion and support from the highest levels of society, Canadian women’s hockey showed the world the true potential of women’s sport. By World War I, teams had emerged in schools across the country. Even though the first generation of women’s hockey players in Canada had no professional outlet and no chance of being paid to play, they quickly developed a high level of skill and sophistication.

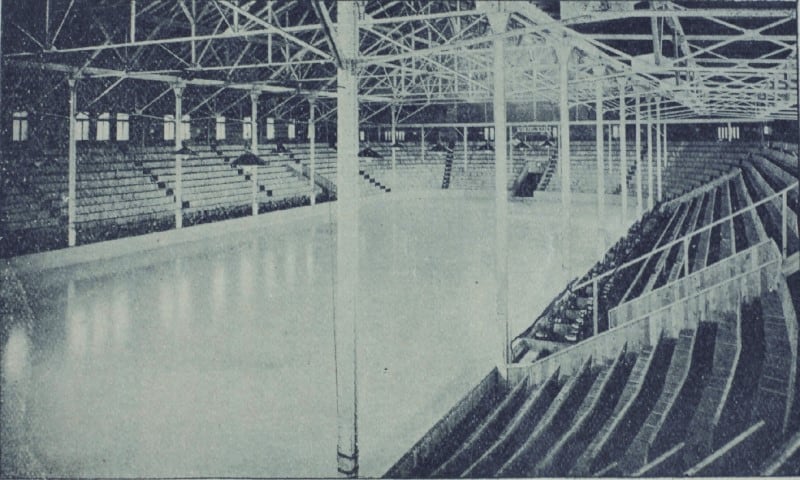

The first women’s professional hockey league formed during the early years of the First World War. Owners of the Jubilee Arena in Montreal saw a fast decline of ice rink used by amateur men’s hockey teams, as players enlisted to become soldiers. Looking to keep their schedule and wallets full, they established the Eastern Ladies’ Hockey League.

While women’s basketball players in the United States, for instance, had to labor under strict female-specific rules, hockey imposed no such restrictions. Professional Canadian women’s hockey players used the same full contact rules as the bruising National Hockey Association. History does not recall many of their names, but most seemed to come from working-class neighborhoods in Montreal.

Canada women’s hockey proved an immediate commercial success. Promoters packed the 3,200-seat hall for almost every game.

By early 1916, newspaper headlines trumpeted the wildfire like the fast growth of Canadian women’s hockey. Soon the sport spread south of the border as teams from the United States and Canada commenced the game’s longest and most heated international rivalry. The first world title went to the Ottawa Alerts, defeating the Pittsburgh Polar Maids in 1917, three games to one.

The excitement from this first explosion of Canada women’s hockey play died away along with the artillery fire. As men started to return from the war in 1919 and reform their leagues, the backers of the women’s league fumbled its transition into the postwar period. Even as the first league disintegrated, the world would soon see the emergence of one of the most dominant sports teams that ever played.

The 30s

Outside of the Harlem Globetrotters, no professional sports franchise has ever enjoyed a run of success like the Preston Rivulettes in the 1930s. Though neither team nor town still exists, the Rivulettes racked up an incredible 98.57 winning percentage back in those golden days, going 345-2-3 during the decade, and winning 26 total titles during their existence. Their dominance extended to include ten straight titles. It even hampered their league’s ability to expand, as other clubs saw no value in joining a league with an unbeatable team.

The Rivulettes demonstrated that hockey had come a long way toward realizing the dreams of Lady Gathorne-Hardy who foresaw a bright future for Canada women’s hockey. By the 1930s, women had traded their long and bulky hoop skirts for pants, jerseys, pads, and other apparel used by men’s teams. The only opponent they failed to defeat was the coming of World War II. Less than a year after the German and Soviet invasion of Poland that kicked off the war, gasoline rationing ended the team’s tour. By the end of the war, many of the players who had made the Rivulettes unbeatable had moved into the military or found other occupations.

The 40s

The demise of the Rivulettes coincided with the start of a dormant period in women’s hockey. Despite robust levels of participation until 1940 at all levels, the number of teams diminished and interest withered. The expansion of the number and the influence of men’s hockey teams crowded out the market for women’s teams. Also, limited ice space saw women’s organizations forced to make way for the men. Women increasingly petitioned, unsuccessfully, to participate in male teams in schools and the minor leagues.

For almost three decades, opportunities for women to play their country’s favorite sport decreased to relatively nothing compared to the first half of the 20th century. Then came a resurgence toward the end of the 1960s.

The 60s

In 1967 Canada celebrated both its national centennial and the reintroduction of high level and competitive women’s hockey. As the nation celebrated 100 years of self-government, 22 teams from across North America came to compete.

Player ages ranged from as old as 50 to as young as nine. Just as in prewar years, the women played under the same rules and as aggressively as the men. Newspaper accounts described bone-crushing body checks and even the outbreak of fistfights.

The postwar generation, however, had almost forgotten about the skill, athleticism, and sheer power, of the earlier years of Canadian women’s hockey. Many came under the impression that they would see a parody of the game, with the women demonstrating more comedy than capability. Spectators, however, walked away impressed with the women’s purpose and professionalism.

The tournament rekindled a national love of Canada women’s hockey. New teams sprouted up across the country, followed by the emergence of the same around the United States and across the world. Never again would women’s hockey be forced into the background by their male counterparts.

Canadian Women’s Hockey League

Although teams got together in the 1960s and 70s for tournaments, including the Dominion, they did not find a league with solid organization and backing until 1992.

Enter the Central Ontario Women’s Hockey League. In its first year of play across the 1992/93 season, only three teams competed. One team from Toronto and two from Scarborough made up the entire league. Within a few years, seven teams filled out the schedule.

Success in Central Ontario inspired the building of a National Women’s Hockey League in 1998, soon joined by the Western Women’s Hockey League founded in 2004.

The surging popularity of women’s hockey combined with the emergence of a pool of highly skilled and talented players led to the establishment of the Canadian Women’s Hockey League, or CWHL in 2007.

These included some of the world’s top players, including Allyson Fox, Sami Jo Small, Jennifer Botterill, and several others.

While the league aspired to match some of the successes enjoyed in the sport a century prior, it also had to endure the same problems that had dogged the women’s version of the sport since its inception. Women’s hockey has almost always enjoyed the support of numerous fans more than commercial and financial backing.

Just as in decades past, some of the top women’s athletes on earth would never receive a paycheck for playing the sport that they love. Even the league’s commissioner and administrators had to work for no pay and keep up day jobs to pay their bills. The only financial compensation for the players came in bonuses earned for winning a title or individual awards. Plans to pay players a minimum salary did not emerge until 2017, shortly before the CWHL shut down.

The league started when the National Women’s Hockey League folded. Like the NWHL, the CWHL pursued the still elusive dream of building a single league for professional women’s hockey. Though all major North American professional sports leagues save Major League Baseball has seen rival leagues emerge and disappear, the difference lies in the established traditions and immense financial backing for organizations such as the NHL, NBA, CFL, and NFL.

Women’s hockey leagues thus far have not enjoyed consistent success and growth that can help them to establish a resilient league.

Famous teams

The CWHL, however, provided the best opportunity for the sport to achieve that goal. It featured a total of 12 teams, although not all existed for the duration of the league. While some, such as the Calgary Inferno, appeared only after the league formed, some, including the Mississauga Chiefs, traced their lineage back to the Central Ontario organization. The Montreal Stars dominated in the first few years of the league, winning three titles in the league’s first five years. The Calgary Inferno emerged more recently to win two titles as part of their run of success.

As players retired, they often stayed on to help their former teams in any way possible. A few years after star goaltender Sami Jo Small retired from playing at the Toronto Furies, she returned as general manager.

From her pocket, she provided much of the team’s equipment while also raising the $65,000 in ticket revenues requested by the league.

The high achieving Markham Thunder squad similarly benefited from having a former player, Chelsea Purcell, serving the organization as general manager.

Through most of its existence, the league was threatened by rival leagues.

While it embraced a business strategy of unifying women’s hockey under its umbrella, it found the Western Women’s Hockey League and the revamped second incarnation of the NWHL unwilling or incapable merger partners.

Merging with the WWHL looked promising in the first years of CWHL operation. In 2009 they started to follow the merger model established by the National Football League and the American Football League in the 1960s. These two leagues opened their partnership by sending champions from each league to play in a world championship game, later dubbed the “Super Bowl.” After a few years, the leagues merged into one organization with teams scheduling each other during the regular season.

Disagreement

Merger plans foundered as the WWHL seemed to collapse from within. Disputes over team mergers and board leadership issues prevented the leagues from coming together. The chaos was punctuated by accusations that the league tried to sabotage the participation of the Minnesota Whitecaps in the championship Clarkson Cup. Some league teams moved to the new NWHL, while others fizzled out.

Controversy, mystery, and accusations of tampering prevented serious talk of merging the new NWHL with the league. Both leagues had expanded into the United States and competed for expanding markets. They clashed head-on in Boston, where the CWHL Boston Blades lost almost their entire roster to the NWHL Boston Pride and other franchises. CWHL officials accused the NWHL of tampering with established contracts, although the international governing body of women’s hockey disagreed.

Despite sniping and failed merger plans, the Canadian Women’s Hockey League looked for partners that could help to keep it afloat. Some individual teams worked out resource sharing arrangements with National Hockey League franchises in the same cities. The NHL itself, however, has not yet invested financial resources or other means of support into any of the women’s hockey leagues, citing their instability and overreliance on grassroots support.

Nevertheless, the Canadian Women’s Hockey League forged a successful partnership with teams from mainland China. The league needed a financial boost from its Kontinental Hockey League partners in China to start paying its players in 2017. Chinese women’s hockey saw the partnership, complete with games scheduled between North American and Asian squads, as a way to boost their national team’s skills and chances of performing well in the 2022 Winter Olympics in Beijing.

With a new revenue stream and a solid season in 2018-2019, the league looked poised to move forward as a legitimate and sustainable professional sports league. Just as the league had seemed to turn a corner, its managing team concluded that the business model could not be sustained.

League End

On March 31, 2019, on the weekly conference call, team owners and other officials learned that the league had decided to shut down operations. Small told SB Nation that the move came as a complete shock.

“There was in my mind zero indication,” Small said, “A lot of times I kind of equate it to a breakup, you look back like, ‘I should have seen that minor issue or this sign.’ I even look back and I don’t see signs.”

Purcell echoed Small’s recollection, explaining that the team general managers had worked to develop ideas to raise more revenues. She described to SB Nation:

“We’re talking all like what we need to improve, what were big steps for next year to continue this movement of growing and how we can get to the next step.”

The popularity of the sport continues to rise, giving hopes for more stability in the future. In February 2019, the NWHL saw the highest attendance ever for a women’s hockey all-star game, selling over 6,000 tickets.

While efforts to form a lasting professional league have faced strong challenges, Canadian women’s hockey continues to dominate the globe in amateur and tournament play. The number of titles earned dwarfs the accomplishments of Canada’s closest rival, the United States. Although teams from Europe and Asia have improved drastically in recent decades, Canada and the US remain the colossi against which all others are judged.

Canada Versus USA Women’s Hockey, One of the World’s Most Bitter Rivalries

US and Canadian teams have competed for world dominance in women’s hockey from the very beginning.

For over a century, the two countries have met at the pinnacle of world competition, starting with the Ottawa Alerts’ decisive three games to one defeat of the Pittsburgh Polar Maids in the 1917 inaugural championships of women’s hockey.

For most of the history of women’s hockey Canada and the United States have provided most of the world’s top players and most exciting international contests. The two countries see title games almost as their own private property; since 1990 only one women’s world hockey championship tournament has seen a non-North American team in the title game.

The short history of women’s Olympic hockey competition shows the same dominance. Out of 18 total medals awarded, 12 went to either the US or Canada.

Only one time has the gold or silver not been won by either North American rival, the lone stray being Sweden who won a single silver medal.

Between the two countries, Canada has the edge in overall titles. The United States has moved ahead in recent years, earning the 2018 Olympic gold medal while also winning the last four International Ice Hockey Federation (IIHF) world championships.

Game stats

Canada and United States World Championships In Women’s Hockey

| Olympics | IIHF Championships | |

| Canada | 4 | 10 |

| United States | 2 | 8 |

The IIHF serves as the governing body for both men’s and women’s hockey across the globe. It sets rules for play, supervises the movement and development of players participating in international programs and the Olympics, and puts on a women’s hockey world championship playoff in all non-Olympic years. IIHF initiatives have helped to boost the profile and popularity of women’s hockey in North America and around the world.

Championship series between Canada and the United States never fail to entertain. Few other rivalries in any other sport bring as high a level of both passion and skilled play. For those who have not experienced women’s hockey, the intensity and will to win manifests itself in hard hits and fistfights just as in the men’s version of the sport.

Almost every game between these two dedicated rivals includes an element of the dramatic. For example, in the 2014 Winter Olympics in Sochi, Team USA entered the final period blanking Canada two to zero. In the final 3:26, however, Canada stormed back to tie. An overtime power-play goal gave them an unlikely and shocking victory.

In the 2018 Pyongyang Winter Games, the United States turned the tables. In another hotly contested defensive struggle, Team USA earned its first gold in two decades via a shootout.

Late in 2019, the rivalry will rekindle anew as the two titans of women’s hockey play a five-game exhibition tour in Canada to prepare for the 2020 IIHF Women’s World Championship. They open the series on December 17 in Moncton, New Brunswick.

Canada looks to reverse its recent bad fortune against the United States in international competition. In November, they handed the US team two decisive defeats at the UPMC Lemieux Sports Complex in Pittsburgh, Pennsylvania. The second game featured an Emily Clark hat trick.

As USA head coach Bob Corkum explained to USAHockey.com, “You have to tip your hat to Canada. They came out and played a wonderful game, and we just didn’t have an answer for them. We’ll go back, look at some video, and get ready for Sunday.”

Canada hopes that the Team USA search for answers continues to come up empty when the host the IIHF Women’s World Hockey Championship tournament in the Spring of 2020.

IIHF Women’s World Hockey Championship Tournament

In 2020, the IIHF Women’s Hockey Championship will celebrate the 30th anniversary of its storied existence when it once again brings together some of the most skilled and passionate athletes in the world.

For its first eight years, it was the definitive competition in the sport, crowning the best women’s hockey tea in the world yearly. When the Winter Olympics first incorporated women’s hockey, this superseded the IIHF tournament’s position in the years it was held.

The IIHF continues to hold women’s tournaments in the Olympic years, but winners do not earn recognition as world champions. Winners of next year’s tournament will receive a world championship title.

IIHF officials have retooled the tournament several times to ensure more evenly matched games among participating teams. This year, the IIHF again introduced a new format. Ten teams will compete in two groups. Each group will hold a round-robin style playoff.

Five teams from Group A and the top three from Group B can advance to the quarterfinals. The remaining two from Group B play for ninth place.

Game rules match those of the men’s sport almost exactly, with one key difference. Body checking receives a minor penalty call in the women’s game.

All players must at least be 18, with certain waivers granted to 16 and 17-year-olds in special situations.

This year’s tournament features exciting competition and fascinating storylines. European champion Finland will seek to try to dethrone the North American titans from holding the title. Denmark also looks to improve its standing under a new coach, medal-winner Peter Elander.

Switzerland and its scoring star Lara Stalder will also test recent changes to their coaching staff that they hope will elevate their performance.

The big story, however, lies in the surging Canadian team that will set its sights on reclaiming the title from their Team USA rivals.

Schedule IIHF 2021

IIHF women’s hockey has already released the groupings as well as the schedule for games next spring (Apr 7, 2021 – Apr 17, 2021).

| Group A | Group B |

| Canada | Czech Republic |

| United States | Denmark |

| Finland | Germany |

| Switzerland | Hungary |

| Russia | Japan |

Group assignment and pairings reflect the IIHF’s commitment to providing even, competitive, and exciting matches between established powerhouses and rising squads. This effort should produce game after game of action-packed thrills and intense play.

This year’s championship provides endless reasons to watch and follow.

Canada remains determined to yank back the title and world dominance from the United States. Finland and other squads see this as their year to join the North Americans at the top of the global women’s hockey tree.

Sports fans of all ages who love to watch perfect combinations of athletic skills along with grit and toughness should pay close attention to how this tournament unfolds next spring. Many expect that this year should offer more competitive games than ever, helping to propel the sport’s popularity even higher.

A Century and a Half of Tradition and Excellence

Lord Stanley and his daughters in their most optimistic dreams could not have forecast the growth and popularity of women’s hockey. From humble beginnings on the frozen lawn of Government House to tournaments bringing skilled and proud squads from three continents, the sport has skyrocketed in popularity and impact.

And proud Canada women’s hockey teams have won the lion’s share of tournaments and titles.

Next spring, teams from as far away as Japan and Russia will help Canada to celebrate both its proud tradition of hockey excellence and the 30th anniversary of women’s championship hockey under the banner of IIHF women’s hockey.

Also, the world will once again see the intensity and excitement of the resumption of Canada versus USA women’s hockey rivalry at the women’s world hockey championship It’s safe to say that Lady Gathorne-Hardy would be brimming over with pride at the leaps that women’s hockey has taken since her time, as well as the accomplishments still to come.